Exemplary Info About How To Obtain Unique Taxpayer Reference

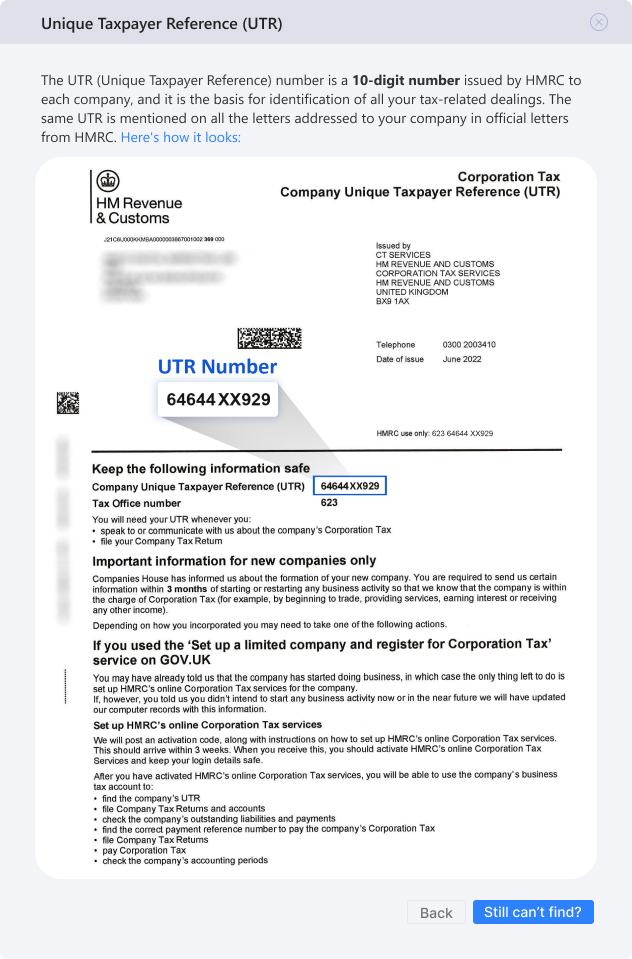

This pattern lets the user enter a unique taxpayer reference (utr).

How to obtain unique taxpayer reference. If you’re waiting for a unique taxpayer reference (utr), you can check when you can expect a reply from hmrc. A unique taxpayer reference (utr) will then be issued by hmrc and delivered to your registered office address within a few days of company formation. Hmrc send your utr number in the post (usually.

Do not call it a ‘unique taxpayer reference number’. How to get a unique taxpayer reference number (utr) now that we’ve covered how important it is, how do you get a utr number? It's sometimes referred to as taxpayer number or just “tax.

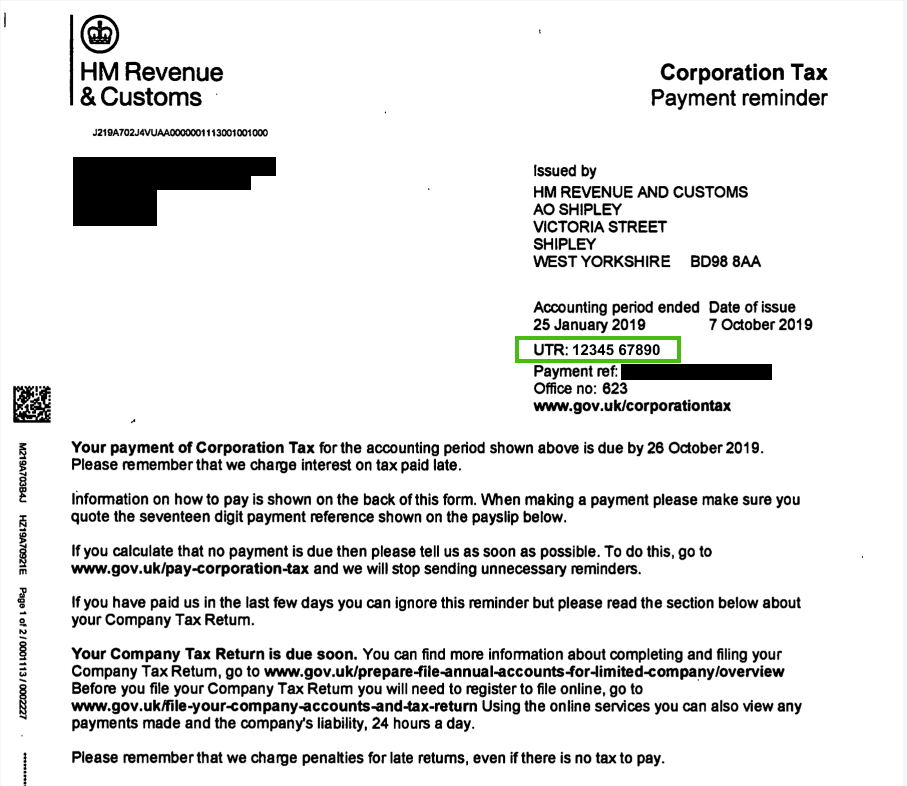

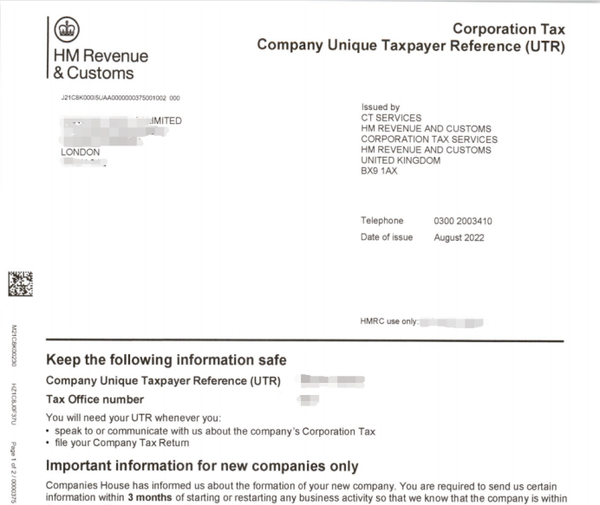

Your company’s unique tax reference will be printed next to a heading like ‘official use’, ‘tax reference’, or ‘utr’ at the top of the first statutory letter delivered. Utr stands for unique taxpayer reference. So what exactly does your utr mean, how can you obtain one, and how do you know what yours is?

The unique taxpayer reference (utr) number is a distinctive identifier assigned by her majesty’s revenue and customs (hmrc) to. Business address and phone number. Go to hrmc's website or fill out the form online,.

A utr number is your unique taxpayer reference. Your unique taxpayer reference number, or. A unique taxpayer reference (or utr) is a number that hmrc uses to track tax payments made by sole traders and companies.

This is posted to your company address by hm revenue and customs ( hmrc) within 14 days. You should check if you need to send a tax. How do i get a unique taxpayer reference number?

Complete guide for beginners.

![Find Your Personal UTR Number [2024]](https://assets-global.website-files.com/5d71eeb2a19ee03e3430f50f/618bbbd6e4373f581237eee7_UTR Number v2.png)