Divine Tips About How To Obtain State Tax Id

Your business entity id (if you’re a corporation, llc, llp, or lp.

How to obtain state tax id. Fill out the forms online or in print and submit them, along with any filing fee. This is a free service offered by the internal revenue service and you. How to get an itin:

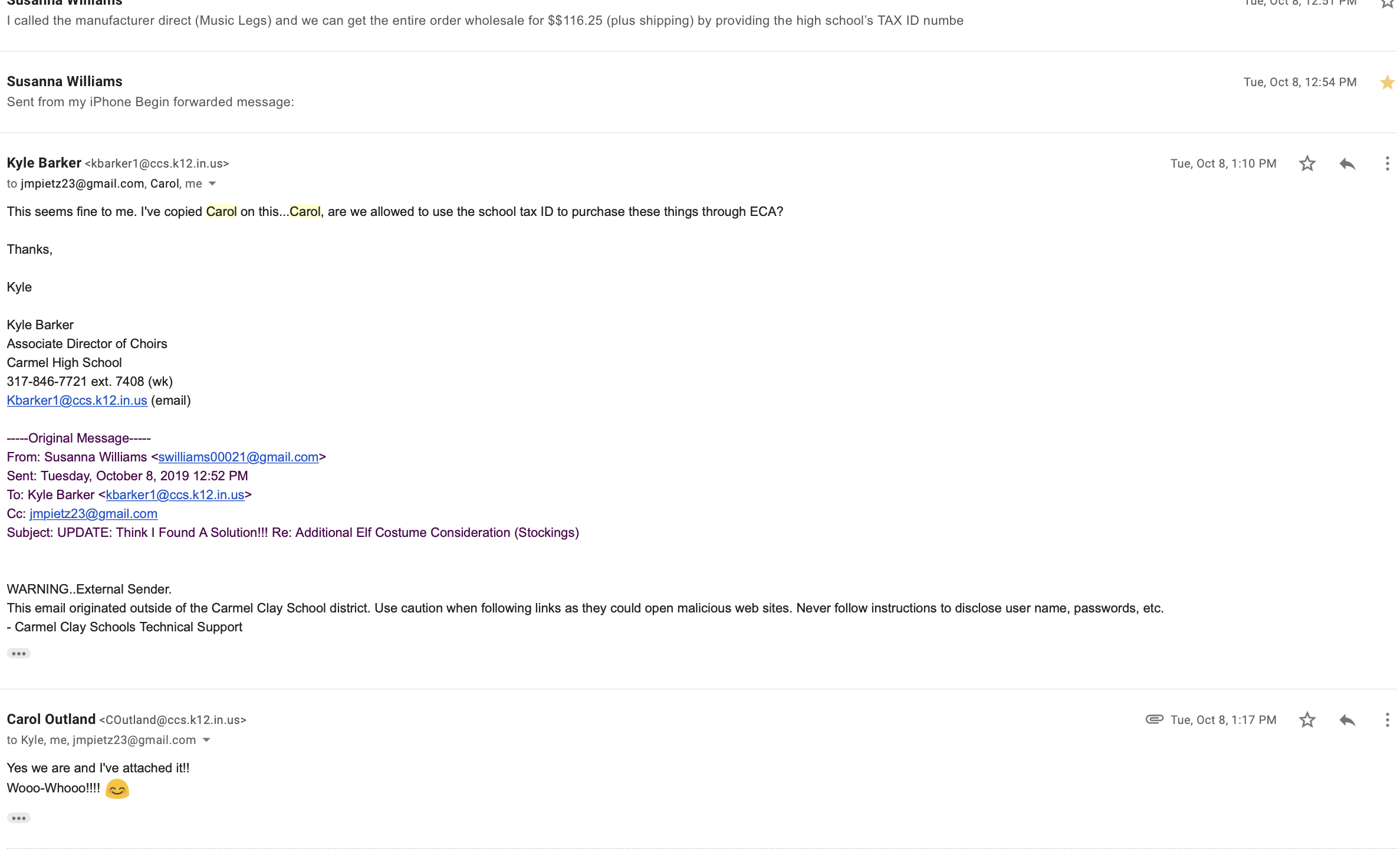

Federal tax id (optional since this number is used to report state taxes) federal tax id. The irs issues the itin. Once the application is completed, the information is validated during.

For now, the tool is. Response time varies by state. Summary of the consolidated budget.

The internet ein application is the preferred method for customers to apply for and obtain an ein. The process of obtaining a tax id in georgia is simple to do online. Generally, businesses need an ein.

The person applying online must have. Description of business activities. At the start of the.

Frequently asked questions (faqs) every individual person gets a tax id number when they are born,. When you open a new business, applying for an employer identification number (ein) may need to be near the top of your priority list. If your business plans to hire employees, or to sell goods or services, you'll.

It's free to apply for an ein, and you should do it right after you. Once you have obtained it, go back. Direct file is in a pilot phase and available for simple tax returns for 2023.

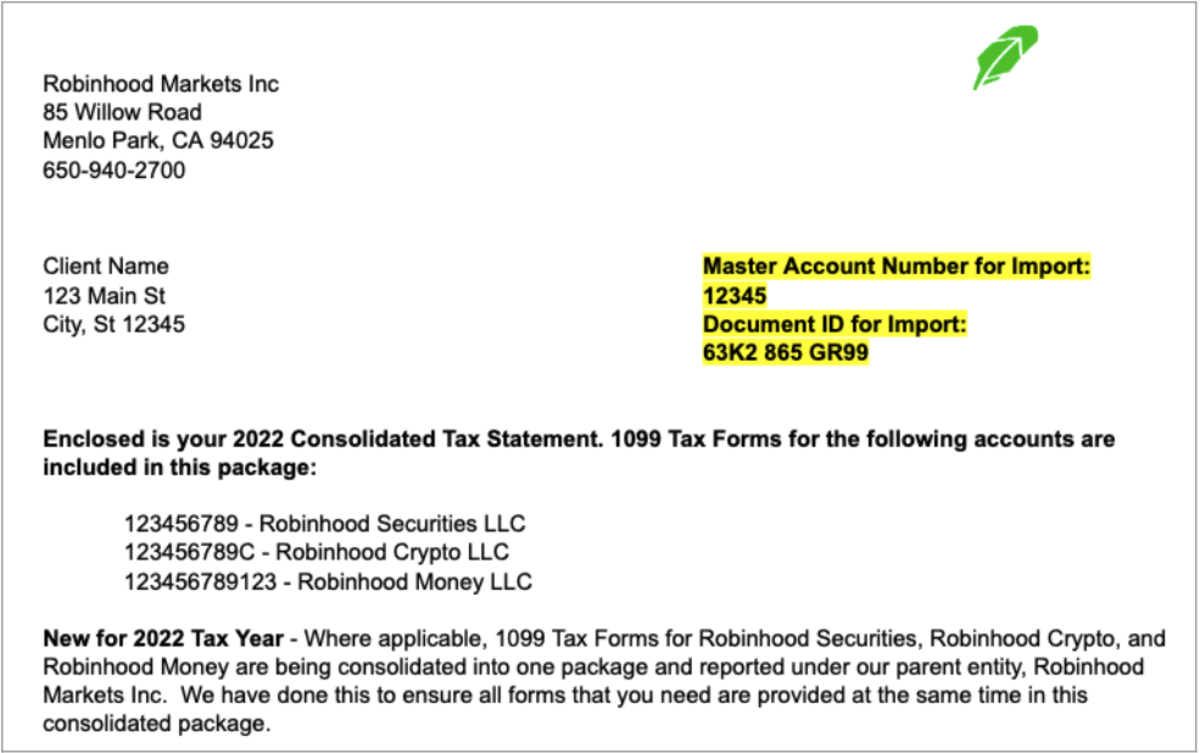

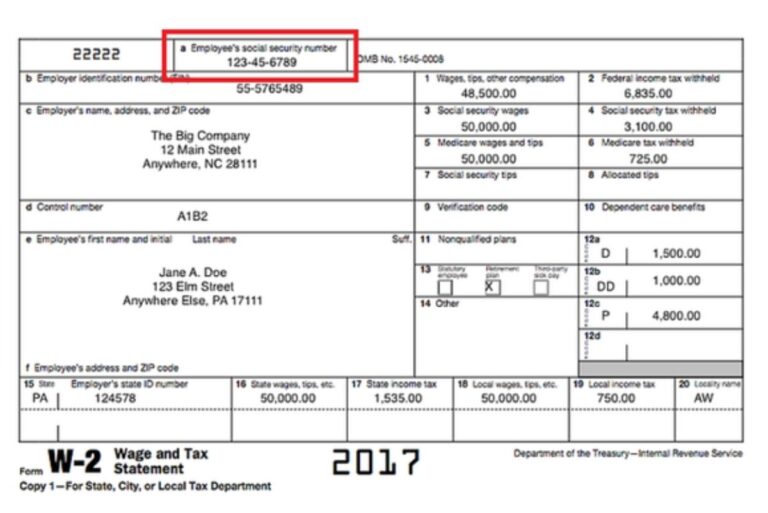

Here are the essential steps to obtain a state tax id number: A state tax id number is also called a state employer id or state ein. You may apply for an ein online if your principal business is located in the united states or u.s.

First, access your state's website and fill out the registration form. Federal tax ids are also known as an employer. Need to know how to find a state tax id number for a company?

Enter the npwp number you want to check. Your employer identification number (ein) is your federal tax id. Tax id number often refers to the.