Outrageous Tips About How To Control Accounts Receivable

How do you send your invoices to.

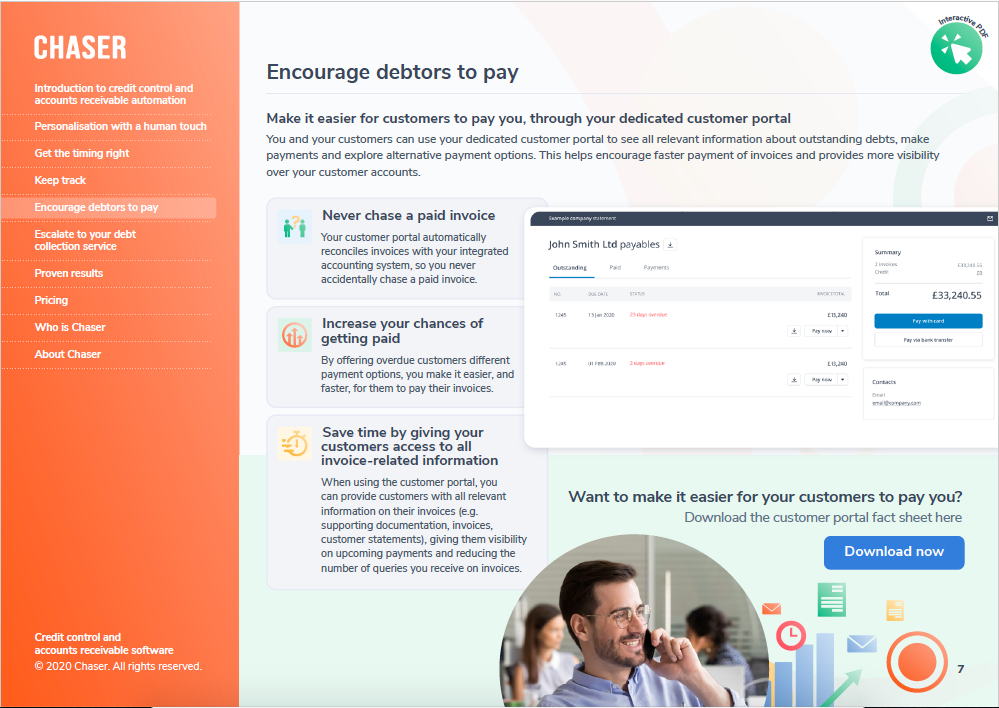

How to control accounts receivable. Accounts payable and accounts receivable control accounts are the most frequently used control accounts, although inventory and fixed asset control accounts. Installment looks at accounts receivable. Pushing customers to pay on time.

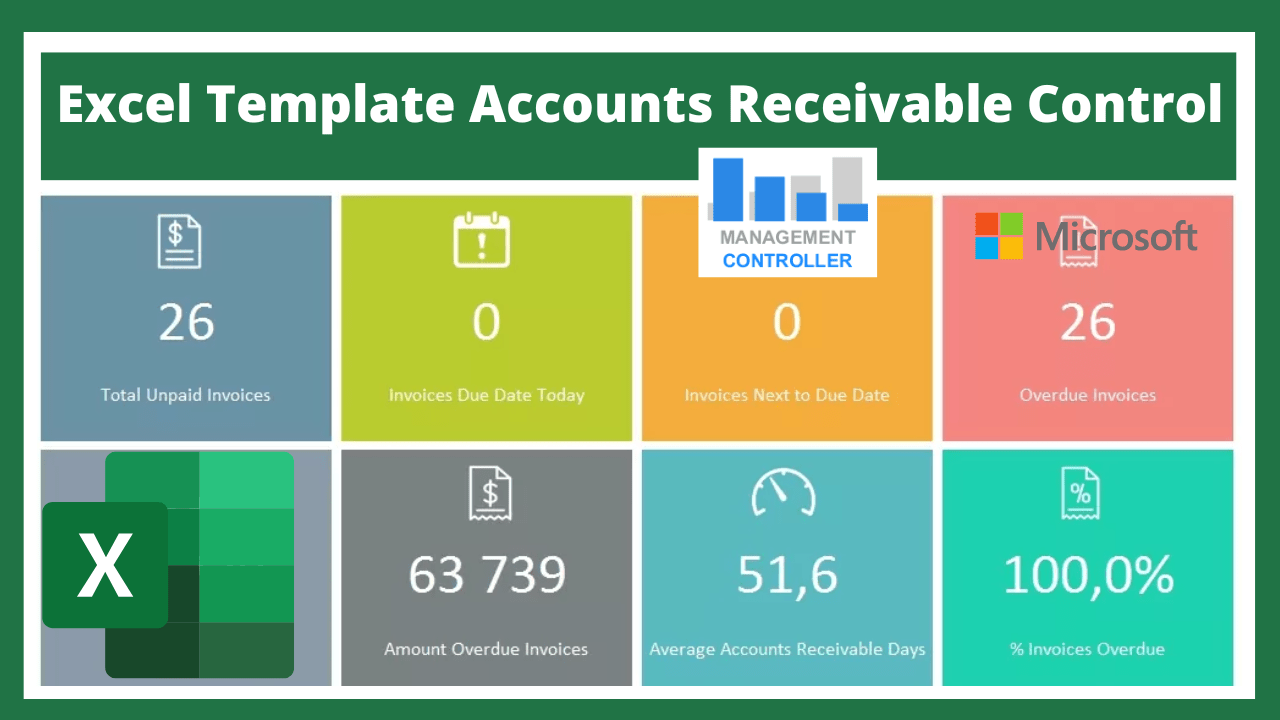

For example, if your accounts. Managing the accounts receivable is extremely crucial for any. A control account is a general ledger account containing only summary amounts.

For small businesses that fight to squeeze every dollar out of their customers and often receive payments days or. With the right strategies, you'll be a receivables collection master quickly. And which accounts does it adjust or control particularly?

The details for each control account will be found in a related (but separate) subsidiary. Taking control of accounts receivable doesn't need to be a painful process. Here are answers to these simple yet.

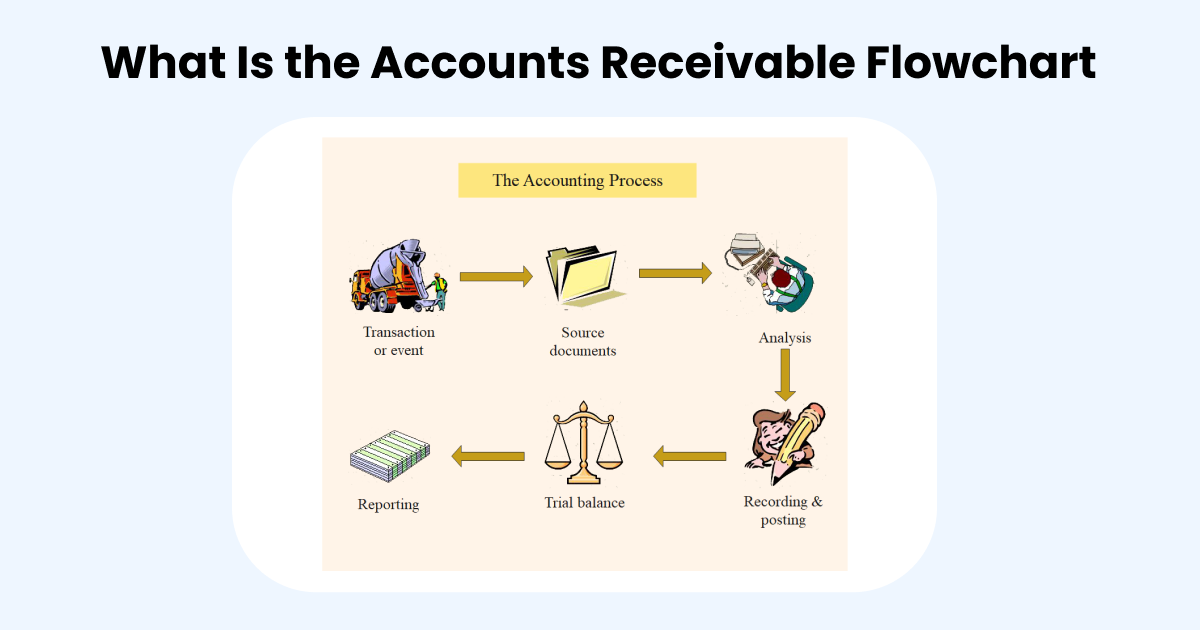

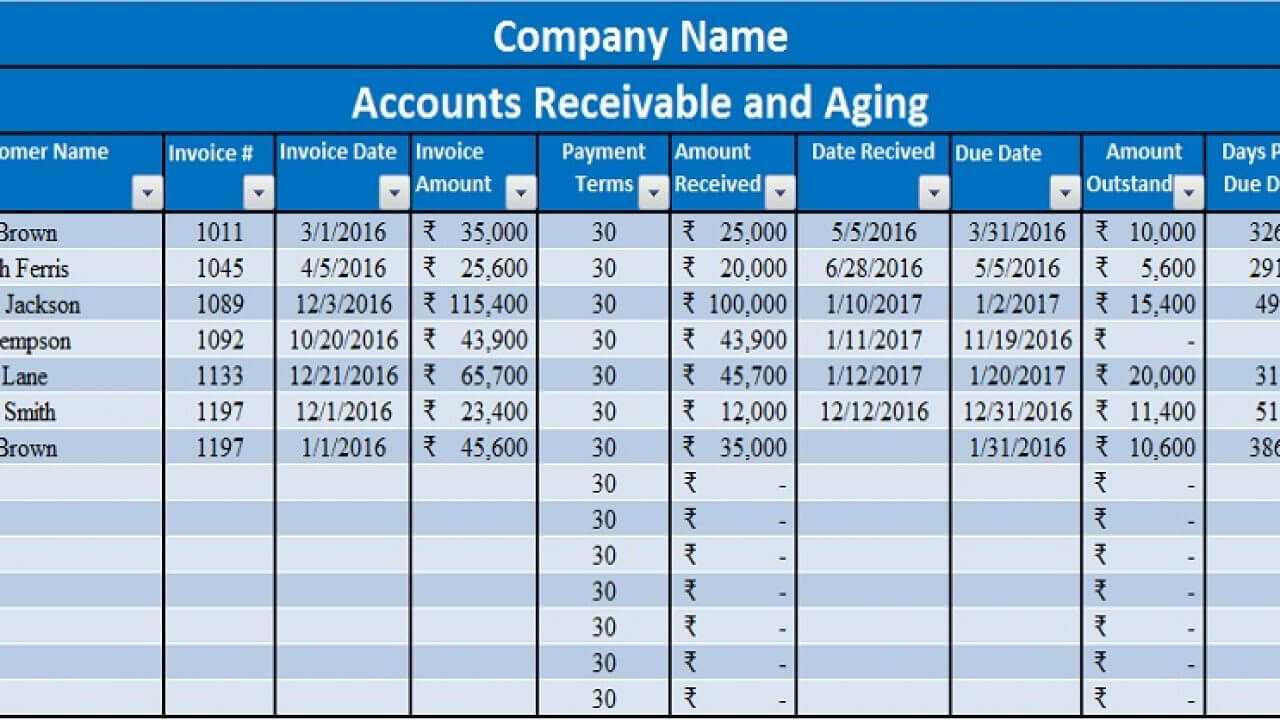

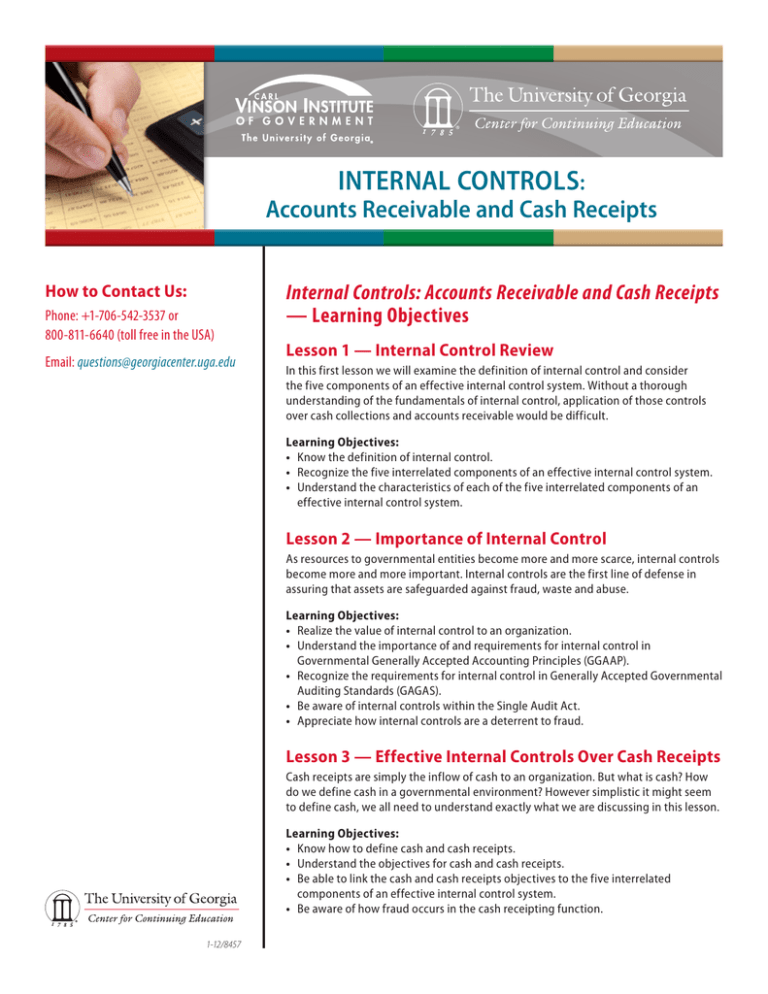

Read on as we uncover. Track and monitor accounts receivable. Controls over accounts receivable really begin with the initial creation of a customer invoice, since you must minimize several issues during the creation of accounts receivable before you can have a comprehensive set of controls over this key asset.

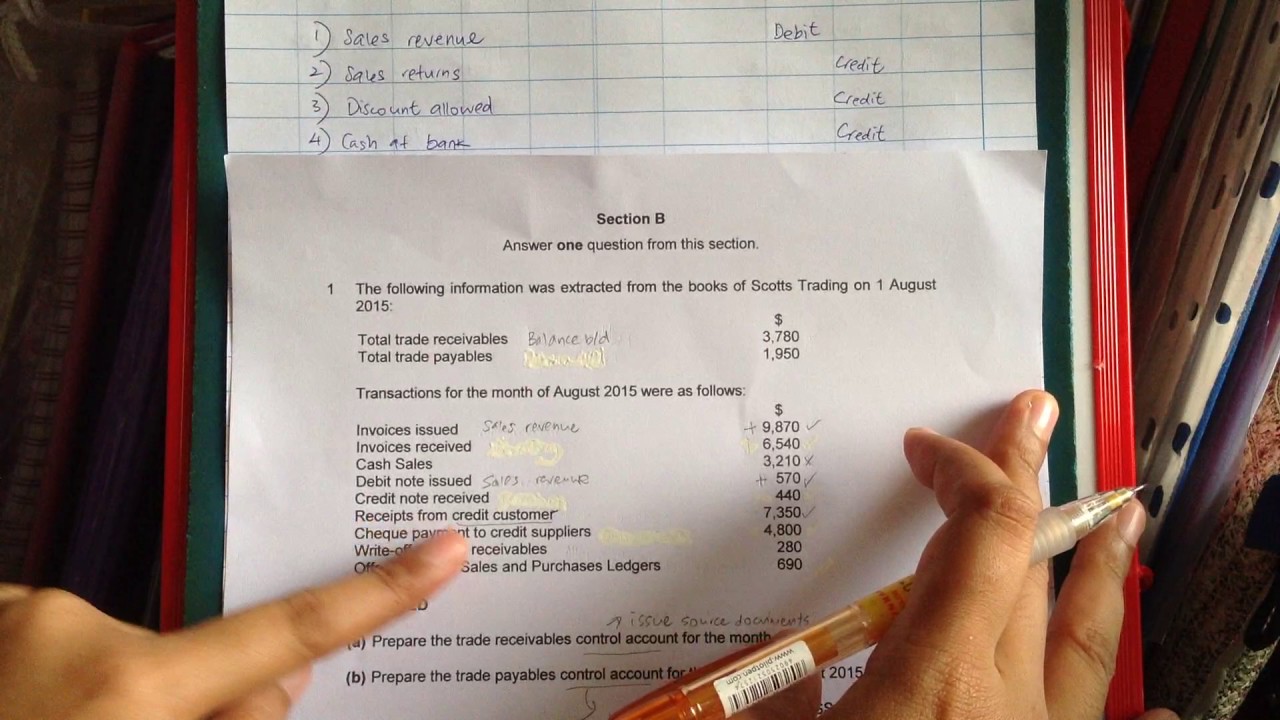

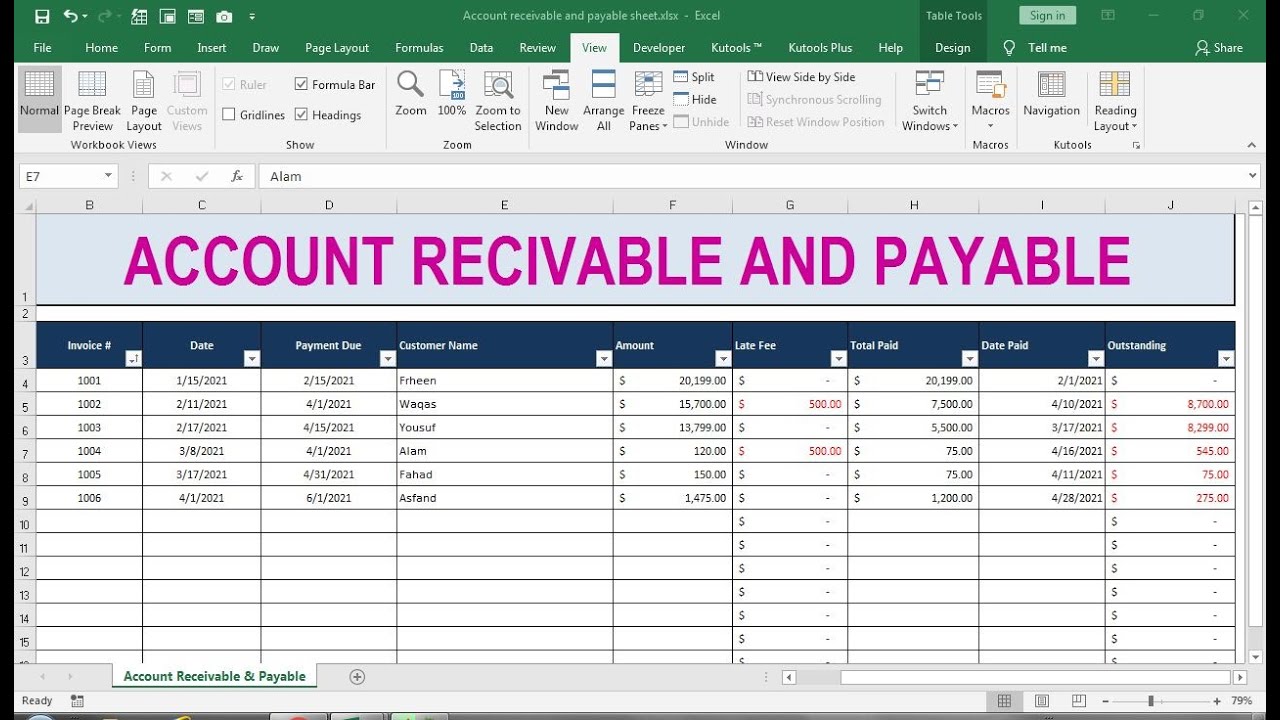

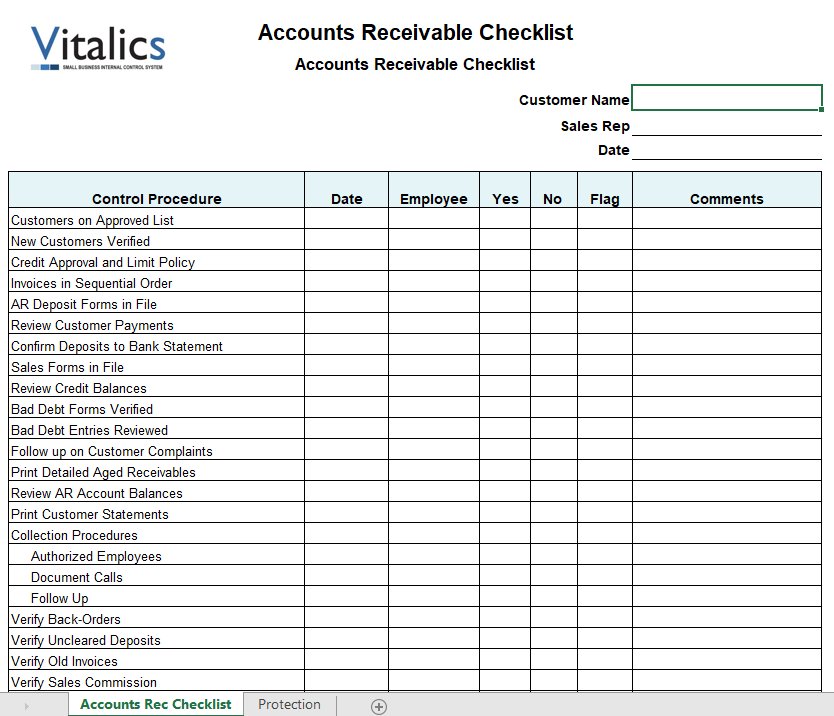

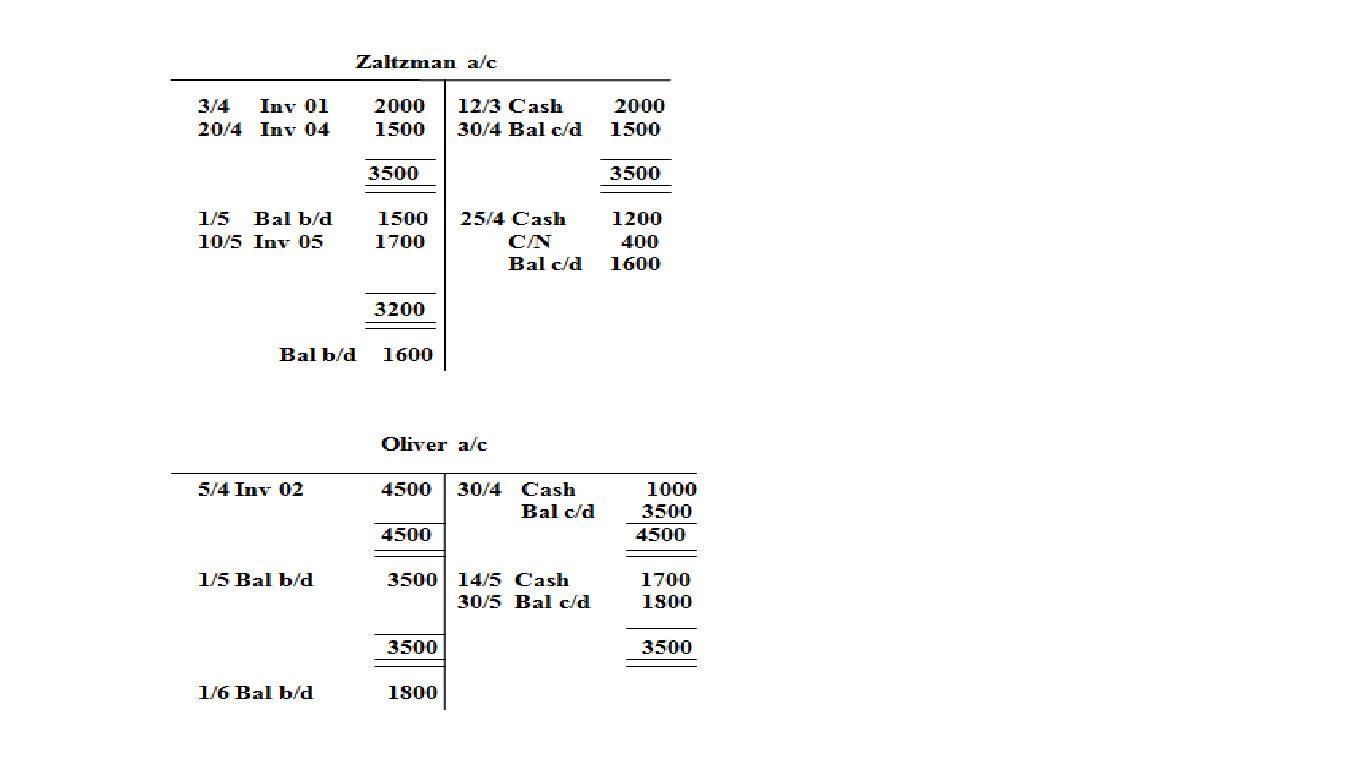

This, summary control account format is widely used to summarise the accounts payables and receivables, because they typically contain huge level of transactions and needs to. The following are some of the most common accounts receivable control methods, a comprehensive accounts receivable control checklist, and additional resources for. Add those two numbers up and divide them by two.

Then determine your accounts receivable at the end of the quarter. Our first tip to more effective accounts receivable tracking is to look at your billing process. What is control account and how does the control account work?

Typically, it boils down to four simple steps: Sectional balancing system. Accounts receivable (1) in running a business, controlling receivables is one of the key aspects that must be taken.

Here are the 4 most important cornerstones every. 1 control accounts control accounts. It is better to receive than to lend.

The use of accounts receivable and accounts payable control accounts creates an accounting system where only the general ledger. The first step of building an effective accounts receivable process is formalising a clear, internal credit control procedure.