Beautiful Tips About How To Decrease Agi

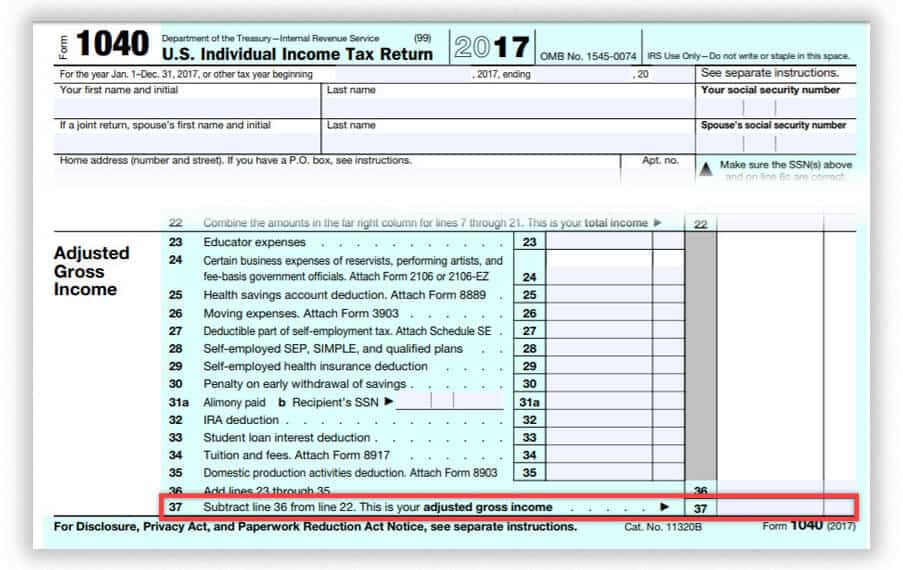

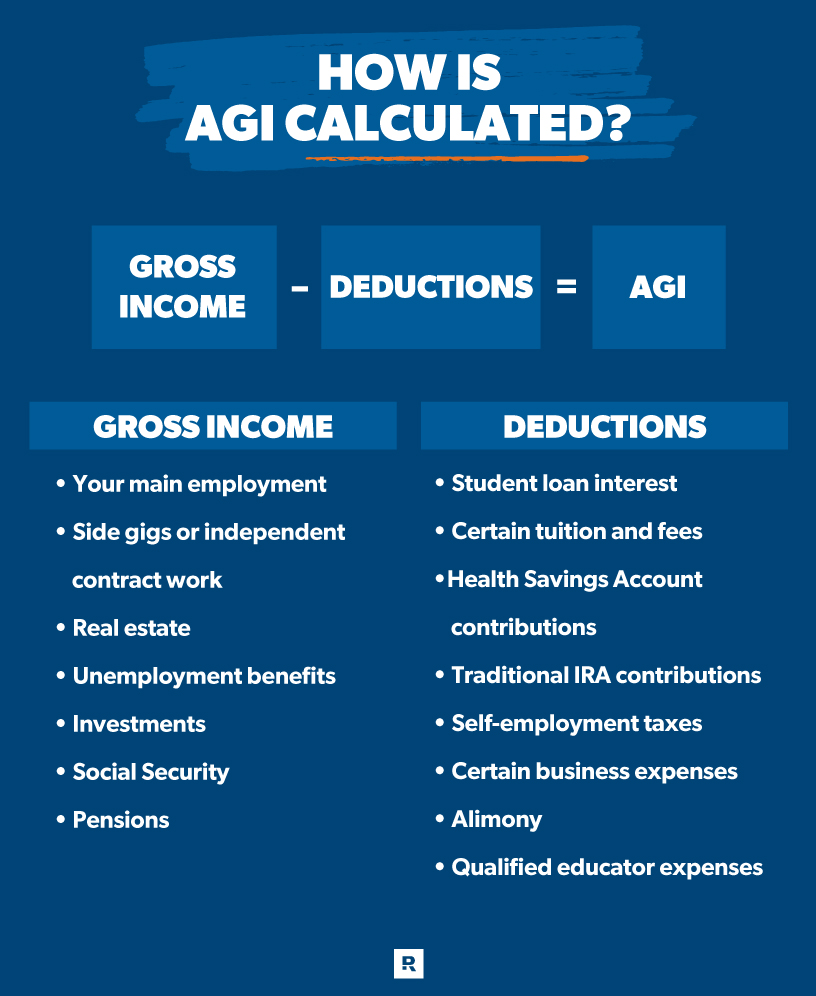

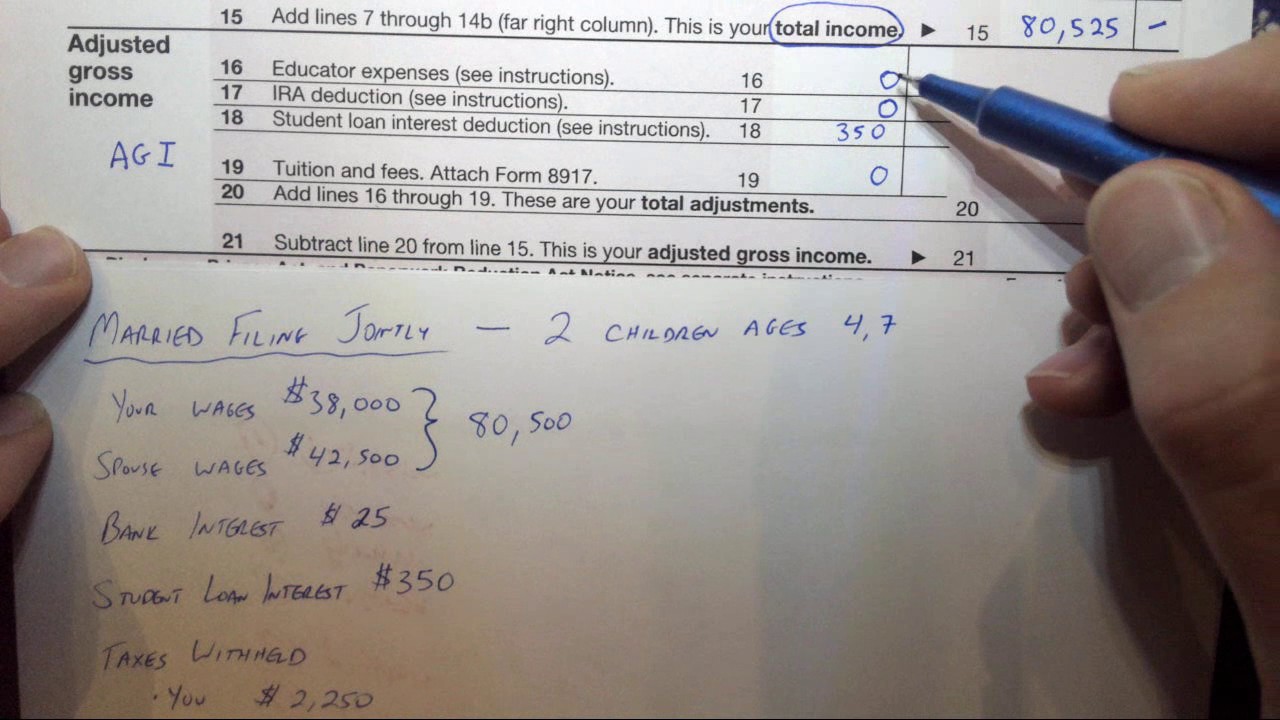

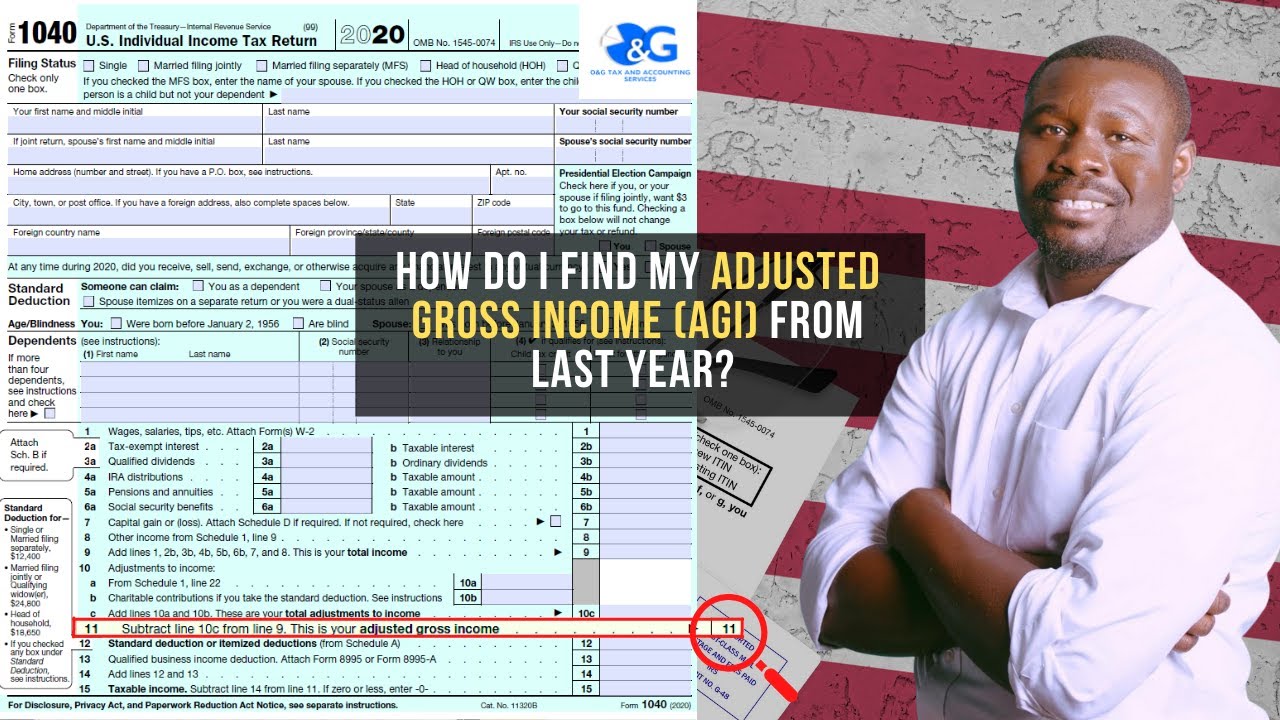

Once your agi has been calculated, subtract a standard or itemized deduction to get to your taxable amount.

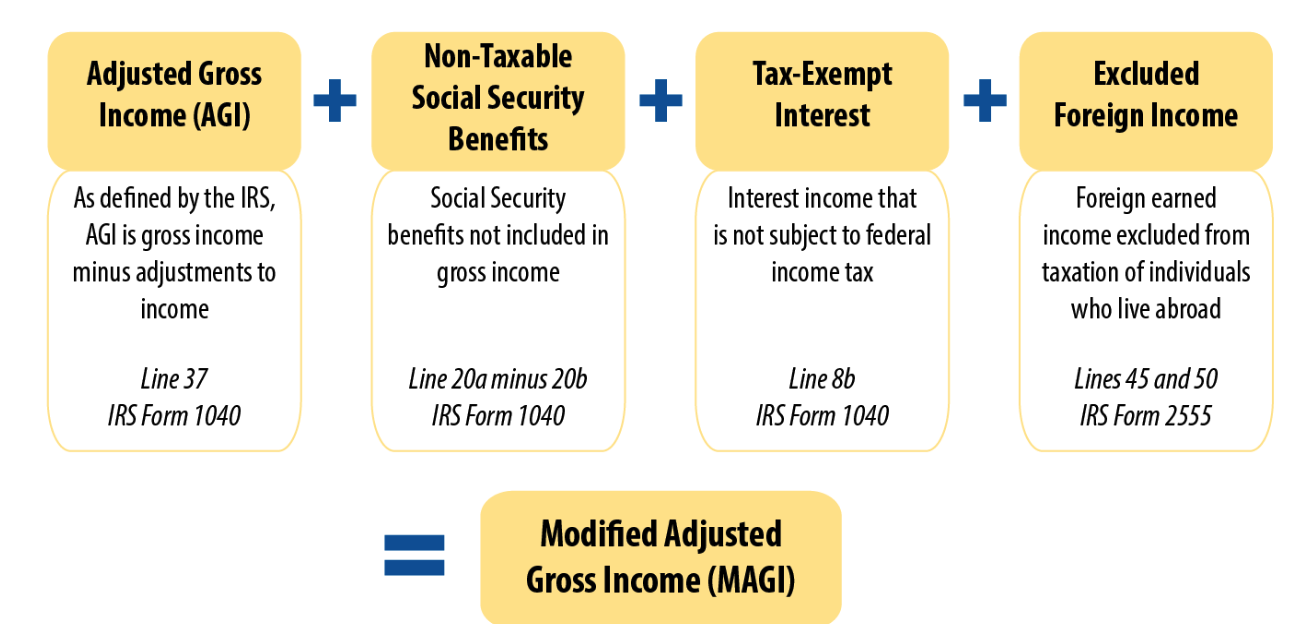

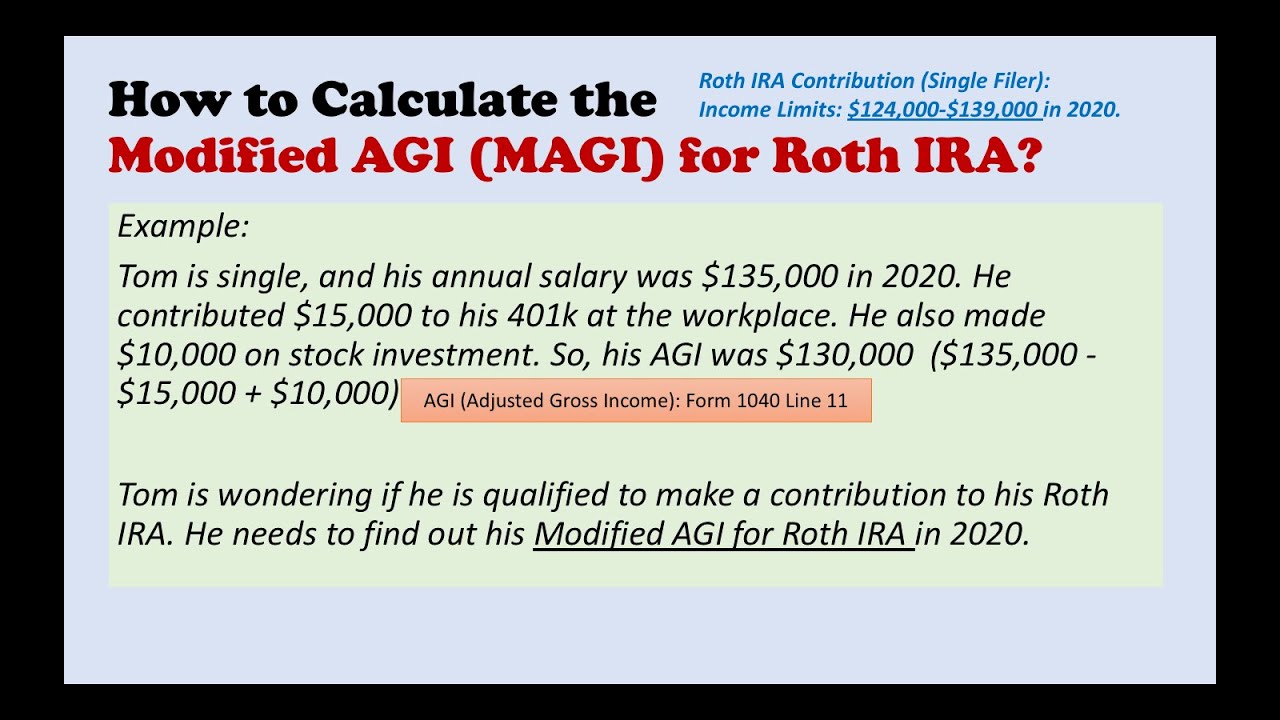

How to decrease agi. Modified adjusted gross income (magi) is your adjusted gross income with some deductions added back in. The lower your agi, the lower your taxes will be. You have three tools for reducing your federal income tax bill:

Here are a couple things taxpayers can do now to lower their agi: The amount is capped at $100,000 annually per person. Understanding your adjusted gross income (agi) and taking steps to reduce it can have a significant impact on your overall tax situation.

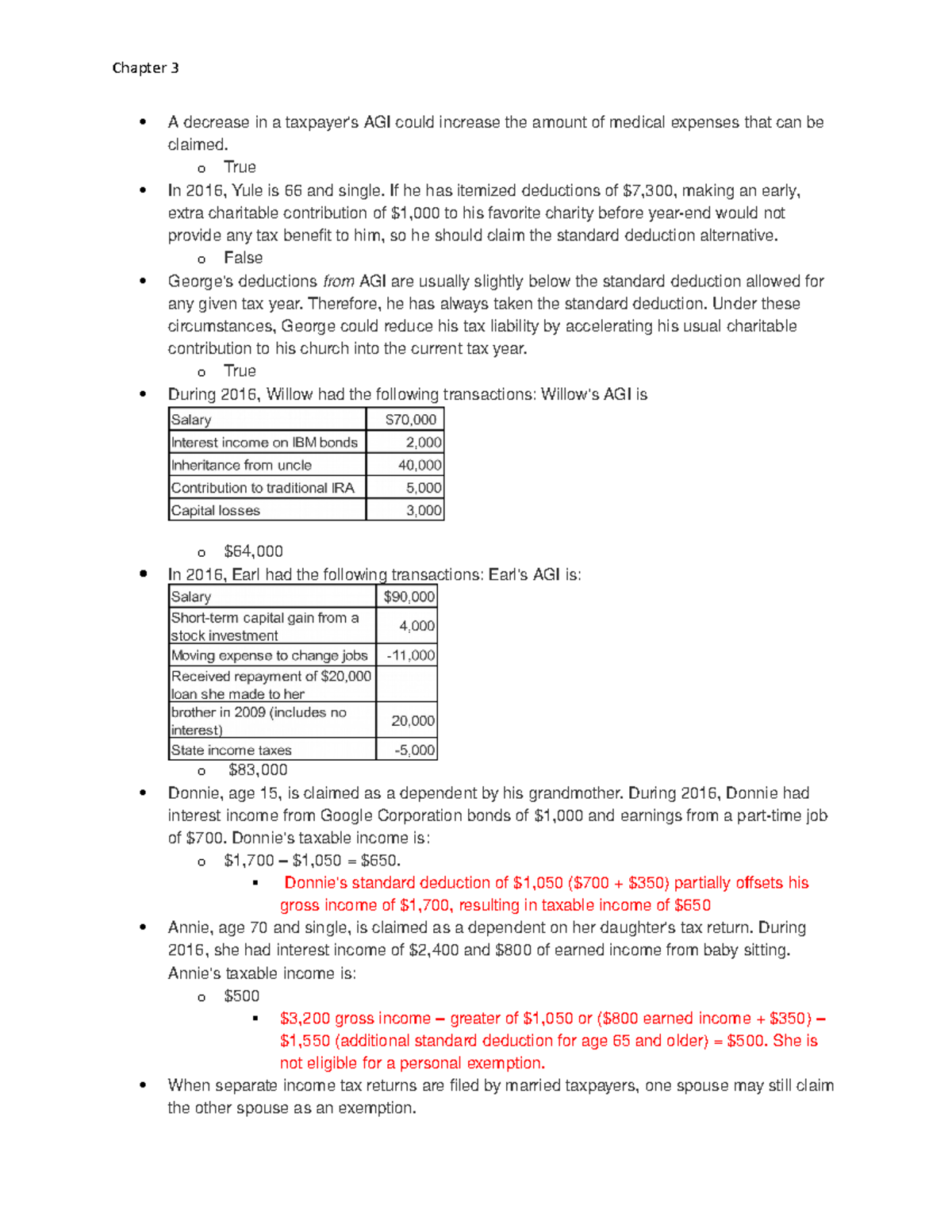

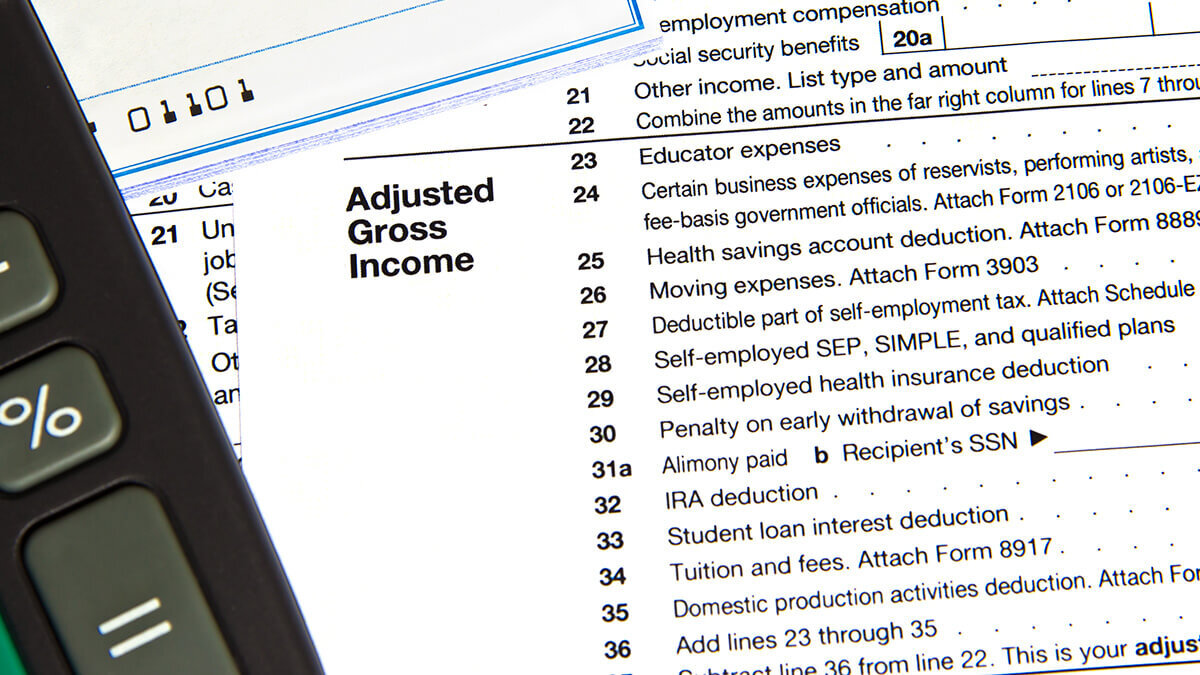

It should be noted that a. How do you reduce your taxable income / agi / magi? Closeup on agi agi equals all taxable income items minus selected deductions for such.

Here are ten ways to reduce your agi (and modified agi) over the short and long run. The potential of tax deferral. The rule can effectively reduce your income taxes by lowering your adjusted gross income (agi).

Retirement plan contributions solo 401k, sep, and traditional ira contributions are tax deductible and directly reduce your agi. Know how adjusted gross income affects taxes a taxpayer’s agi and tax rate are important factors. The irs doesn’t tax what you divert directly from your paycheck into a.

Decrease agility) is a 1 st class active skill available as acolyte, super novice and some mercenaries. Decrease agi (alt: Take advantage of adjustments to lower taxable income;

Table of contents determining your agi reporting gross total income deductions for agi click to expand key takeaways • your total income includes your. Traditional 401 (k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). Effect attempts to place a debuff on a.

Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills.