Unique Info About How To Apply For Insulation Rebate

Home energy rebate programs requirements and application instructions;

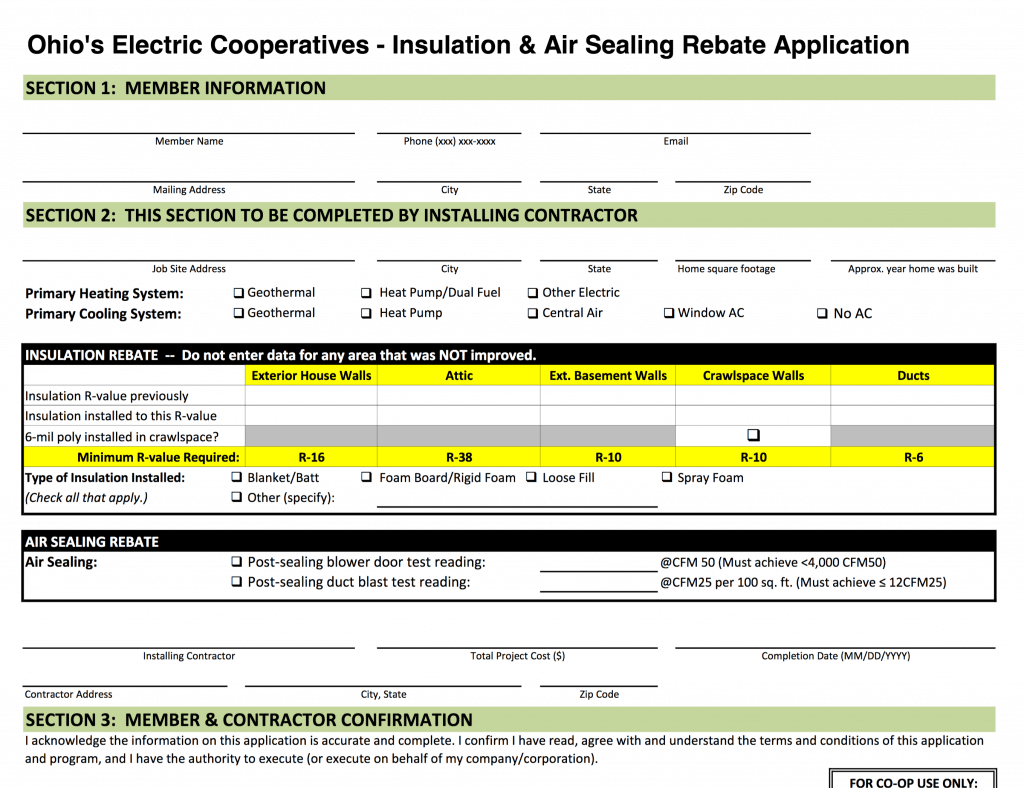

How to apply for insulation rebate. Home information such as year built, square footage, address, etc. What is the inflation reduction act? Applications must be submitted within six months of the paid invoice date.

If you make less than 80% of your area's median income, you can receive a rebate. Interactive guide to energy credits available under the inflation reduction act. Get cash back on insulation upgrades when you work with a bayren participating contractor.

This tax credit is effective for products purchased and installed between january 1, 2023, and december. Doe released new resources to help state and territorial energy offices apply for and implement their home efficiency rebates program under the inflation reduction act's. For each area of the home, limit one rebate per insulation type, for the lifetime of the.

To complete your application you will need: How to get home insulation upgrades at no upfront cost. For example, 20% of the total ceiling area, regardless of how many.

View full general eligibility requirements. See a list of faqs about tax credits for energy star products and energy. Once your insulation is installed you can apply online or by mail.

Rebates cannot exceed the paid cost on the invoice. Get insulation incentives when you insulate a minimum of 20% of the total building component area. Which provisions in the inflation reduction act (ira) establish home energy rebates?

Your rebate will be applied as a credit on your electricity bill. What does the credit cover for insulation projects? Hot water heat pumps.

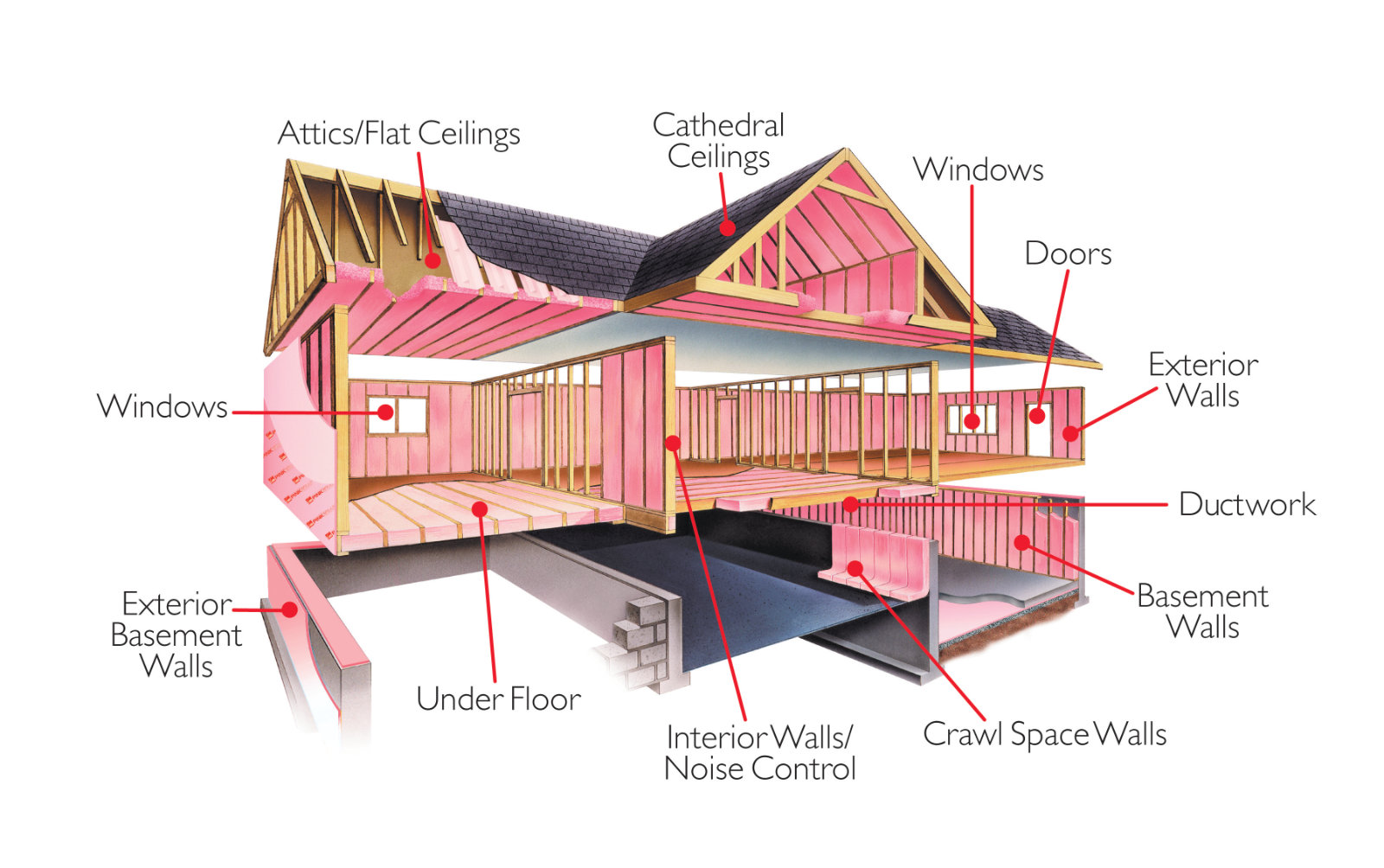

See which upgrades qualify, including the minimum required. 30% of eligible insulation and air sealing systems expenses up to $1200 ; Citizens who live in an eligible home and have residential utility accounts with bc hydro, fortisbc, or municipal utility.

How to apply for a rebate. A copy of your proof of purchase. Credits and deductions under the inflation reduction act of 2022.

How do you get the insulation tax credits and rebates? Click here to download a printable rebate application. Insulation and weatherization ($1,600) unlike the tax credits, these rebates are based on your income level:

/man-installing-insulation-182186960-583dfbb05f9b58d5b170a0ee.jpg)

![Foil insulation roll [Best Answer!]](https://c1.wallpaperflare.com/preview/464/724/864/building-insulation-scaffolding-clouds.jpg)